Table of Contents

ToggleTata Motors Result

Tata Motors recorded consolidated sales of Rs. 346,000 crore in the fiscal year ended March 2023, the greatest yearly sales in the company’s history and exceeding pre-COVID levels. This marks a 24% year-on-year growth above sales of Rs. 278,000 crore the previous year. Furthermore, the firm generated a combined operating profit of Rs. 31,920 crore, a 29% increase over the previous year’s operating profit of Rs. 24,720 crore. Tata Motors also managed to keep its operating profit margin at 9%.

The corporation has suffered net losses on a consolidated basis for the previous four years. Tata Motors, on the other hand, became profitable in the current fiscal year, declaring a consolidated profit of Rs. 2,690 crore, equivalent to earnings per share of Rs. 7.27 for the whole year. This is a huge improvement over the previous year, when the business had a combined loss of Rs. 11,309 crore.

Tata Motors has been profitable for two straight quarters on a quarterly basis. The firm announced its highest-ever consolidated revenue of Rs. 105,932 crore in the quarter ended March 2023, combined with an operating profit of Rs. 13,114 crore. This quarter’s operational profit margin was 12%. Furthermore, the net profit for the March 2023 quarter was Rs. 5,496 crore.

Fundamentally Speaking

Fundamentally, based on publicly accessible statistics, Tata Motors’ current enterprise value is roughly Rs. 2,87,239 crore. At the present market price of Rs. 531, this amounts to an EV/EBITDA ratio of only 7.86 times. In comparison, Maruti and M&M have EV/EBITDA ratios of 21 times and 10 times, respectively, while Ashok Leyland has a ratio of 15 times. This suggests that Tata Motors’ stock is selling at a reasonable valuation.

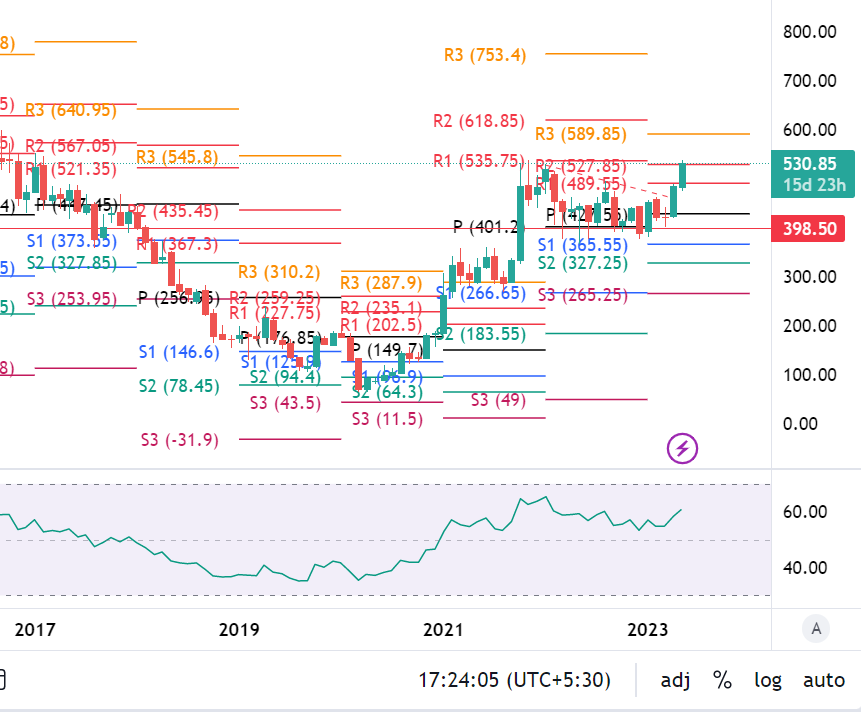

Technically Speaking

Technically, the monthly chart indicates a rising trend with good support at the 430 mark.

It is crucial to note that the material in this post is offered solely for educational reasons and should not be construed as advice to buy, sell, or hold securities. This post’s author is not a SEBI-registered research analyst.