Investing in the stock market can be a lucrative opportunity for those seeking to grow their wealth. However, investing in the pharmaceutical industry in India requires a thorough analysis of various factors to make informed decisions.

This comprehensive guide aims to provide investors with a clear understanding of the key factors to consider when analyzing pharmaceutical companies for stock market investment in India.

Whether you are a seasoned investor or new to the stock market, this guide offers a valuable resource for analyzing pharmaceutical companies in India for stock market investment. By following the steps outlined in this guide, investors can make informed decisions that help them achieve their investment goals.

Table of Contents

Toggle1. Researching the Pharmaceutical Industry in India

When analyzing pharmaceutical companies for stock market investment in India, it’s essential to conduct research and understand the industry’s trends and regulations. The pharmaceutical industry in India is dynamic, with several emerging trends and regulatory changes that can impact investment decisions.

A. Understanding industry trends and regulations

The pharmaceutical industry in India is a highly regulated industry, and it is essential to understand the latest industry trends and regulations to make informed investment decisions. Here are some of the key industry trends and regulations that investors need to be aware of:

Generic Drugs:

One of the major industry trends in India’s pharmaceutical industry is the increasing demand for generic drugs. With the rising cost of branded drugs, generic drugs have become a popular choice among patients due to their lower cost. As a result, several pharmaceutical companies in India have shifted their focus towards generic drugs, which has led to an increase in the production and sale of generic drugs.

Research and Development (R&D):

Another significant trend in the Indian pharmaceutical industry is the increasing focus on research and development (R&D). Indian pharmaceutical companies are investing heavily in R&D to develop innovative drugs and treatments. The Indian government has also introduced several initiatives to encourage R&D in the pharmaceutical industry, such as tax incentives and funding support.

Regulations:

In terms of regulations, the Indian government has introduced several regulations to ensure the safety and efficacy of drugs. The Central Drugs Standard Control Organization (CDSCO) is the regulatory body responsible for regulating the pharmaceutical industry in India. The CDSCO regulates the development, manufacturing, marketing, and distribution of drugs in India. Additionally, the Indian government has also introduced price control regulations for essential drugs to ensure that they are affordable and accessible to the general public.

The National List of Essential Medicines is a significant regulation that has impacted the pharmaceutical industry in India. The list includes essential drugs that are considered necessary for public health, and the government has imposed price controls on these drugs. This has led to a decrease in revenue and profitability for some pharmaceutical companies that manufacture these drugs.

B. Examining market segments and growth prospects

The pharmaceutical industry in India is one of the fastest-growing industries in the world, and it offers a wide range of investment opportunities for investors. To make informed investment decisions, it is essential to examine the various market segments and growth prospects within the industry.

Generic drugs Growth:

One of the significant market segments in the Indian pharmaceutical industry is generic drugs. Generic drugs are copies of brand-name drugs that have the same active ingredients, dosage form, and strength. These drugs are cheaper than branded drugs and offer significant cost savings to patients. According to a report by the Indian Brand Equity Foundation, the Indian generic drug market is expected to grow at a compound annual growth rate (CAGR) of 15.92% between 2020 and 2025.

OTC Drugs:

Another significant market segment in the Indian pharmaceutical industry is over-the-counter drugs (OTC). OTC drugs are medications that can be sold directly to consumers without a prescription. These drugs include painkillers, cough and cold medicines, and other commonly used medications. The OTC drug market in India is expected to grow at a CAGR of 9.32% between 2020 and 2025, according to a report by Mordor Intelligence.

Biosimilars Big Opportunity:

Biosimilars are another significant market segment in the Indian pharmaceutical industry. Biosimilar are biological products that are highly similar to an approved biological product. The market for biosimilars in India is expected to grow significantly due to the increasing demand for biologics and the introduction of regulatory guidelines for biosimilar development. According to a report by Research and Markets, the biosimilar market in India is expected to grow at a CAGR of 22.7% between 2020 and 2025.

C. Identifying leading players and emerging opportunities

Identifying leading players in an industry requires a deep understanding of the industry’s dynamics and the companies’ capabilities. One of the most important factors to consider is a company’s product portfolio.

Companies that offer a wide range of products are often more stable and less vulnerable to market fluctuations than companies that have a narrow product range. Additionally, companies that have a mix of branded and generic products can cater to a broader customer base and provide a more stable revenue stream.

R&D capabilities are another important factor to consider. Companies that invest heavily in R&D are often at the forefront of innovation and are more likely to bring new and innovative products to the market. This can be an important competitive advantage in an industry where technological advances can quickly make existing products obsolete.

Lupin Limited is a good example of a leading player in the Indian pharmaceutical industry. Lupin has a diverse product portfolio that includes branded and generic drugs. Additionally, the company has a strong focus on R&D, with over 2,200 scientists working in various research facilities worldwide. This has helped Lupin develop innovative products and establish itself as a key player in the industry.

Identifying emerging opportunities requires a deep understanding of the industry’s future trends and customer needs.

For example, the demand for specialty drugs is growing rapidly due to the increasing prevalence of chronic diseases and the aging population. Companies that specialize in the development and commercialization of these drugs are likely to benefit from this trend. One such company is Vertex Pharmaceuticals, which specializes in drugs for cystic fibrosis and has been one of the best-performing stocks in the healthcare sector in recent years.

Another emerging opportunity in the Indian pharmaceutical industry is the CRAMS sector. CRAMS involves outsourcing the research and manufacturing services of drugs to specialized companies. The CRAMS industry in India is growing rapidly due to the availability of skilled manpower and a favorable regulatory environment.

Companies such as Divis Laboratories and Jubilant Life Sciences are well-positioned to benefit from this trend due to their expertise in chemistry and manufacturing processes.

2. Studying the Pipeline of Drugs

A company’s pipeline of drugs can provide valuable insights into its future growth potential and the likelihood of commercial success.

A. Examining the company’s pipeline of drugs and development stage

The pipeline refers to the company’s portfolio of drugs that are in various stages of research and development, from early-stage discovery to commercialization.

The pipeline’s success can have a significant impact on the company’s revenue and profitability in the long term. For example, a pharmaceutical company with a blockbuster drug in its pipeline can potentially generate significant revenue for many years. On the other hand, if a company’s pipeline lacks promising drugs, it may struggle to sustain revenue growth and profitability over time.

Here are some key factors to consider when examining a pharmaceutical company’s pipeline of drugs and their development stage:

Diversification of the Pipeline:

A company with a diversified pipeline that spans multiple therapeutic areas can provide more stability in its revenue stream and better risk management. For example, a company with multiple drugs in different stages of development in oncology, cardiovascular, and neurological disorders may be better positioned to weather challenges in any one area.

Development Stage of the Pipeline:

The development stage of the pipeline can also impact the company’s financial prospects. Early-stage drugs may have higher risks and uncertainties, while late-stage drugs may have a higher likelihood of approval and commercialization. Therefore, a company with a balance of early-stage and late-stage drugs in its pipeline may offer a more attractive risk-return profile.

Market Potential:

It’s essential to consider the market potential of the drugs in the pipeline. For example, a drug addressing a high unmet medical need in a large market may have a higher revenue potential than a drug addressing a small market.

Competition:

The level of competition in the therapeutic area can also impact the pipeline’s potential for success. A highly competitive market may require significant investment in clinical development and marketing, potentially reducing the drug’s profitability.

One helpful resource for examining a company’s pipeline is the company’s annual report, which provides detailed information about the pipeline’s drugs and their development stage. Another resource is clinicaltrials.gov, which lists all clinical trials underway for a particular drug. Additionally, investors can use websites such as EvaluatePharma, which provides comprehensive analysis of the pharmaceutical industry and specific companies.

Bristol Myers Squibb (BMS):

Let’s consider the pipeline of Bristol Myers Squibb (BMS), a leading pharmaceutical company. BMS has a diversified pipeline of drugs in various stages of development, spanning multiple therapeutic areas such as oncology, immunology, and cardiovascular diseases. In its 2020 annual report, BMS reported that it had 46 compounds in clinical development, including 10 late-stage compounds.

One notable drug in BMS’s pipeline is Opdivo, an immune checkpoint inhibitor used to treat various types of cancer. Opdivo generated over $7 billion in revenue for BMS in 2020 and is one of the company’s top-performing drugs. Additionally, BMS has multiple other drugs in its pipeline addressing various types of cancer and immunological disorders, such as Breyanzi and Zeposia.

3. Assessing potential for approval and commercial success

The success of a drug ultimately depends on its ability to gain regulatory approval and to be commercially successful in the market. Here are some key factors to consider when assessing a pharmaceutical company’s potential for approval and commercial success:

Clinical Trial Results:

Clinical trial results are critical indicators of a drug’s potential for approval and commercial success. Positive clinical trial results can demonstrate the drug’s safety and efficacy, which are necessary for regulatory approval and market adoption. For example, if a drug shows significant improvement in disease progression or symptom relief in clinical trials, it may have a higher likelihood of approval and commercial success.

Regulatory Environment:

The regulatory environment can also impact a drug’s potential for approval and commercial success. Regulatory agencies such as the FDA or EMA require drugs to meet specific safety and efficacy standards before approval. Understanding the regulatory landscape and the requirements for approval can provide insights into the potential for approval and commercial success of a drug.

Competitive Landscape:

The competitive landscape can also impact a drug’s potential for commercial success. A highly competitive market may require significant investment in clinical development and marketing, potentially reducing the drug’s profitability. Understanding the competition and the drugs in development in the same therapeutic area can provide insights into a drug’s potential for commercial success.

Market Demand:

Understanding market demand is crucial in assessing a drug’s potential for commercial success. A drug addressing a high unmet medical need in a large market may have a higher revenue potential than a drug addressing a small market. Additionally, understanding the pricing environment and reimbursement landscape can provide insights into the potential for commercial success of a drug.

4. Analyzing R&D investments and partnerships

When analyzing a pharmaceutical company, it’s essential to assess its research and development (R&D) investments and partnerships. R&D is critical to the pharmaceutical industry, as it drives innovation and the development of new drugs. Here are some key factors to consider when analyzing R&D investments and partnerships:

R&D Investments:

The amount of money a company invests in R&D can provide insights into its commitment to innovation and drug development. A company that invests a significant portion of its revenue in R&D may have a stronger pipeline of drugs and greater potential for future growth.

Research Capabilities:

The company’s research capabilities are also critical to consider. For example, a company with strong internal research capabilities may have a better chance of developing successful drugs than a company that relies heavily on external partnerships. Evaluating the company’s research capabilities can provide insights into its potential for future drug development.

Partnerships:

The company’s partnerships can provide access to cutting-edge research and development capabilities. For example, a company with partnerships with leading academic institutions and research centers may have access to a broader pool of expertise and resources, increasing its potential for successful drug development. Evaluating the company’s partnerships can provide insights into its research and development capabilities and potential for future drug development.

Collaboration Agreements:

Collaboration agreements with other companies can also provide insights into the company’s potential for future drug development. For example, if a company has collaboration agreements with multiple companies across different therapeutic areas, it may have a more diversified pipeline and greater potential for future growth.

For example, let’s consider the pharmaceutical company Pfizer. Pfizer is one of the world’s largest pharmaceutical companies and has a strong pipeline of drugs in various stages of development. Pfizer invests a significant portion of its revenue in R&D, with $9.8 billion invested in 2020 alone.

Pfizer also has a strong internal research capability, with multiple research centers worldwide. Additionally, Pfizer has partnerships with leading academic institutions and research centers, such as the University of Oxford and the National Institutes of Health. These partnerships provide Pfizer with access to cutting-edge research and development capabilities, increasing its potential for successful drug development.

Another example is Merck, a leading pharmaceutical company. Merck invests a significant portion of its revenue in R&D, with $12.7 billion invested in 2020 alone. Additionally, Merck has collaboration agreements with multiple companies across different therapeutic areas, including AstraZeneca and Eisai. These collaboration agreements provide Merck with access to new technologies and potential drug candidates, increasing its potential for successful drug development.

5. Understanding the Regulatory Environment

The pharmaceutical industry is highly regulated, and changes in regulations can significantly impact a company’s revenue and profitability.

A. Knowing regulations governing the pharmaceutical industry in India

The Central Drugs Standard Control Organization (CDSCO) is responsible for regulating and overseeing the pharmaceutical industry in India. Here are some key regulations that investors should be aware of:

Drug Development:

CDSCO regulates the development of new drugs in India. Pharmaceutical companies must obtain approval from CDSCO before conducting clinical trials in India. Additionally, the CDSCO regulates the import of new drugs for clinical trials and requires that all imported drugs are approved by the regulatory authorities in their country of origin.

Manufacturing:

CDSCO regulates the manufacturing of pharmaceutical products in India. All pharmaceutical manufacturing units must be licensed by CDSCO, and the facilities must comply with Good Manufacturing Practices (GMP) guidelines. The CDSCO conducts regular inspections of manufacturing facilities to ensure compliance with GMP guidelines.

Pricing:

The National Pharmaceutical Pricing Authority (NPPA) regulates the pricing of pharmaceutical products in India. The NPPA sets the maximum retail price (MRP) for all pharmaceutical products sold in India. The NPPA also monitors the prices of essential drugs to ensure that they are affordable and accessible to the general population.

Distribution:

CDSCO regulates the distribution of pharmaceutical products in India. All pharmaceutical products must be transported and stored under appropriate conditions to ensure their safety and efficacy. The CDSCO also monitors the sale and distribution of prescription drugs to prevent their misuse.

B. Understanding pricing policies and patent laws

The Indian government has implemented various pricing policies to make essential drugs affordable and accessible to the general public. Additionally, understanding the patent laws is essential to assess the company’s ability to protect its intellectual property and commercialize its products.

C. Identifying any legal or regulatory risks

Identifying any legal or regulatory risks associated with investing in pharmaceutical companies is crucial. For example, companies may face legal challenges related to drug development, manufacturing, or distribution. Understanding the potential risks associated with legal or regulatory challenges can help investors make informed decisions and mitigate risks.

6. Monitoring Market Trends

Monitoring market trends is an essential part of analyzing pharmaceutical companies for stock market investment in India. Here are some of the key areas to focus on when monitoring market trends:

A. Analyzing demand for pharmaceutical products and competition

One of the most critical market trends to monitor is the demand for pharmaceutical products and competition. The Indian pharmaceutical industry is highly competitive, and companies need to keep up with the latest market trends to stay ahead of the competition. Analyzing the demand for pharmaceutical products and assessing the competition can provide valuable insights into the company’s revenue and growth potential.

For example, the demand for generic drugs is expected to increase in India, as they are more affordable than branded drugs. Similarly, there is a growing demand for specialty drugs, which are high-cost drugs used to treat complex and chronic medical conditions. By monitoring these trends, investors can identify companies that are well-positioned to benefit from the growing demand for pharmaceutical products.

B. Identifying emerging opportunities

Identifying emerging opportunities is another critical aspect of monitoring market trends. The Indian pharmaceutical industry is rapidly evolving, with new technologies, drugs, and treatment methods being developed. By identifying emerging opportunities, investors can identify companies that are at the forefront of these developments and likely to benefit from them.

For example, emerging opportunities in the Indian pharmaceutical industry include the development of biosimilars, the increasing demand for contract research and manufacturing services (CRAMS), and the growing demand for personalized medicine. By monitoring these emerging opportunities, investors can identify companies that are likely to benefit from these trends.

C. Watching for geopolitical, economic, or social factors that could impact the industry or the company’s performance

Finally, investors should monitor geopolitical, economic, or social factors that could impact the industry or the company’s performance. For example, changes in government policies, trade agreements, or global economic conditions can significantly impact the pharmaceutical industry. Similarly, social factors such as changing demographics or healthcare policies can impact the demand for pharmaceutical products.

By monitoring these factors, investors can identify potential risks and opportunities and adjust their investment strategy accordingly.

7. Analyzing the Financials of the Company

The financial performance of a company can provide valuable insights into its growth potential, profitability, and financial stability.

A. Examining revenue growth, earnings, and profitability

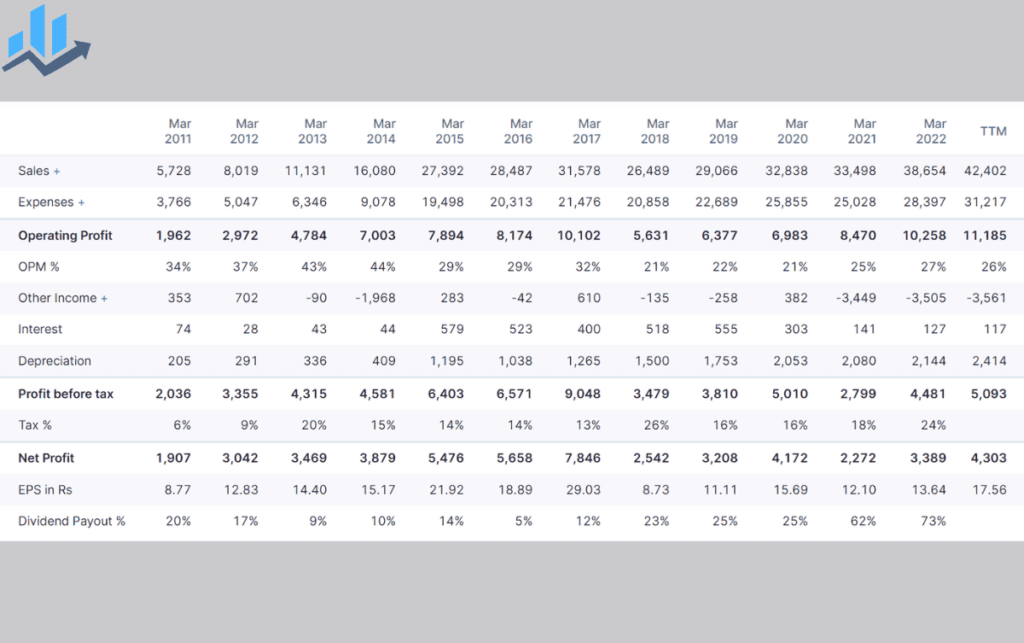

To examine revenue growth, earnings, and profitability of a pharmaceutical company, one can use screener.in, a financial analysis tool for Indian stocks. Screener.in provides comprehensive financial data for companies, including revenue growth, earnings, and profitability ratios.

To use screener.in to examine a company’s revenue growth, one can search for the company’s name or ticker symbol on the website and navigate to its financials page. On this page, one can view the company’s revenue growth over the years, which is displayed in a graph format. Screener.in also provides a table of revenue data for each year, which can be downloaded for further analysis.

Earnings can be analyzed by examining a company’s earnings per share (EPS) and its trend over the years. Screener.in provides EPS data for each year, which can be viewed in a graph format or downloaded in a table. The website also provides information on the company’s dividend history, which can be an additional indicator of earnings stability.

Profitability metrics such as operating profit margin and net profit margin can be analyzed using screener.in’s financials page. Operating profit margin is a measure of how much profit a company makes for every rupee of revenue generated, while net profit margin is a measure of the percentage of revenue that translates into profit after accounting for all expenses.

Screener.in provides both these ratios for each year, which can be viewed in a graph format or downloaded in a table.

For example, let’s examine the financials of Sun Pharmaceutical Industries Limited using screener.in. Sun Pharma is one of the leading pharmaceutical companies in India, and we can use screener.in to analyze its financials.

On screener.in, we can search for “Sun Pharmaceutical Industries Limited” and navigate to its financials page. Here, we can see that the company’s revenue has grown consistently over the years, from Rs. 5728 crore in 2011 to Rs. 38654 crore in 2022, with a CAGR of 16.98%.

Examining the company’s profitability ratios, we can see that its operating profit margin has been consistently above 20% over the years, indicating a strong profitability. The company’s net profit margin has also been consistently above 10%, indicating a healthy return on investment.

B. Assessing debt levels, cash flow, and financial stability

When it comes to assessing a pharmaceutical company’s financial health, it’s essential to consider several factors. One crucial aspect is the company’s debt levels, which can be an indicator of its financial risk. Excessive debt levels can lead to higher interest expenses, which can eat into the company’s profits and limit its ability to invest in future growth opportunities.

Another crucial factor to consider is the company’s cash flow. Positive cash flow indicates that the company has enough cash to cover its operating expenses, debt payments, and investments. It can also provide the company with the flexibility to pursue strategic opportunities and weather economic downturns. On the other hand, negative cash flow can be a warning sign, indicating that the company may struggle to meet its financial obligations.

Finally, assessing a pharmaceutical company’s financial stability involves looking at its balance sheet and cash reserves. A company with a strong balance sheet, which shows a healthy ratio of assets to liabilities, can be an indication of financial stability. Additionally, a company with a significant amount of cash reserves can provide a cushion against unforeseen events or economic downturns. All this financial information is easily available on screener.in

C. Considering key financial ratios such as debt-to-equity ratio, current ratio, and return on equity (ROE)

Considering key financial ratios such as debt-to-equity ratio, current ratio, and return on equity (ROE) can help assess the company’s financial health and stability. For example, a low debt-to-equity ratio indicates that a company has less debt and is less risky, while a high current ratio indicates the company’s ability to meet short-term financial obligations. A high ROE indicates that the company is generating high returns on its investments and is efficiently utilizing shareholder’s equity.

8. Evaluating the Management

A company’s success depends on the leadership and vision of its management team, and assessing their track record, leadership style, strategic vision, and decision-making ability can provide valuable insights into the company’s future growth potential.

A. Analyzing the management team’s track record and leadership style

Analyzing the management team’s track record and leadership style can help investors understand their approach to managing the company. For example, a management team with a successful track record of managing pharmaceutical companies can provide confidence to investors that the company is in capable hands. Additionally, understanding their leadership style can help investors assess the management team’s ability to navigate challenges and capitalize on opportunities.

B. Assessing the strategic vision and decision-making ability

Assessing the strategic vision and decision-making ability of the management team is essential when analyzing pharmaceutical companies. Investors should consider the company’s long-term strategy and how it aligns with industry trends and regulations. The management team’s ability to make timely and informed decisions can help the company adapt to changing market conditions and take advantage of emerging opportunities.

C. Examining experience, past decisions, and regulatory and competitive challenges

Examining the management team’s experience, past decisions, and regulatory and competitive challenges can provide valuable insights into their ability to lead the company. For example, if the management team has experience in developing and commercializing innovative drugs, this can be a positive indicator of future success. Additionally, understanding how the management team has navigated regulatory and competitive challenges in the past can help investors assess their ability to handle similar challenges in the future.

9. Comparing with Peers

Here are two key areas to focus on when comparing with peers:

A. Comparing financials, management, and growth prospects with industry peers

Comparing financials, management, and growth prospects with industry peers can provide valuable insights into the company’s position in the market. Investors can compare the financial performance of a company with its peers in terms of revenue growth, profitability, debt levels, and cash flow. Additionally, investors can analyze the management team’s track record and leadership style to determine if they are well-positioned to lead the company to success.

For example, if a pharmaceutical company’s revenue growth and profitability are below its peers, this could be a red flag for investors. Similarly, if a company’s management team lacks experience or has a poor track record, this could impact the company’s performance in the long term.

B. Analyzing valuation metrics such as price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio

Analyzing valuation metrics such as price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio can provide valuable insights into the company’s valuation relative to its peers. Investors can use these metrics to determine if a company is overvalued or undervalued compared to its peers.

For example, if a company has a higher P/E ratio than its peers, it may indicate that investors are willing to pay a premium for the company’s growth prospects. Similarly, if a company has a lower P/S ratio than its peers, it may indicate that the company is undervalued and has growth potential.

10. Conclusion

Analyzing pharmaceutical companies for stock market investment in India requires a holistic approach that considers various factors. Understanding industry trends and regulations, examining the company’s financials, evaluating management, studying the pipeline of drugs, understanding the regulatory environment, monitoring market trends, and comparing with peers are all critical factors to consider when making informed investment decisions.

Investors should be aware of the regulatory environment, including pricing policies and patent laws, and identify any legal or regulatory risks. It is also essential to consider market trends, emerging opportunities, and geopolitical, economic, or social factors that could impact the industry or the company’s performance.

A holistic analysis that considers all these factors can help investors identify investment opportunities in the pharmaceutical industry in India. By considering key factors such as revenue growth, earnings, profitability, debt levels, cash flow, and financial stability, investors can make informed decisions and evaluate the potential for investment in a particular company.

11. Questions & Answers:

Why is it important to analyze pharmaceutical companies for stock market investment in India?

It is important to analyze pharmaceutical companies for stock market investment in India because the pharmaceutical industry is a critical sector in India’s economy, and it offers significant investment opportunities. The industry is highly regulated, and there are various factors to consider when evaluating the potential for investment.

What are some key factors to consider when researching the pharmaceutical industry in India?

When researching the pharmaceutical industry in India, some key factors to consider include understanding industry trends and regulations, examining market segments and growth prospects, and identifying leading players and emerging opportunities.

What financial factors should investors examine when analyzing a pharmaceutical company in India?

When analyzing a pharmaceutical company in India, investors should examine financial factors such as revenue growth, earnings, profitability, debt levels, cash flow, and financial stability. Additionally, considering key financial ratios such as debt-to-equity ratio, current ratio, and return on equity (ROE) can provide valuable insights.

What are some key factors to consider when evaluating the management of a pharmaceutical company in India?

When evaluating the management of a pharmaceutical company in India, investors should analyze the management team’s track record and leadership style, assess the strategic vision and decision-making ability, and examine experience, past decisions, and regulatory and competitive challenges.

Why is it important to study the pipeline of drugs when analyzing a pharmaceutical company in India?

Studying the pipeline of drugs is important when analyzing a pharmaceutical company in India because it provides insights into the company’s potential for future growth and success. Examining the company’s pipeline of drugs and development stage, assessing potential for approval and commercial success, and analyzing R&D investments and partnerships can all provide valuable insights.

What is the regulatory body responsible for regulating the pharmaceutical industry in India, and why is it important to understand the regulatory environment?

The regulatory body responsible for regulating the pharmaceutical industry in India is the Central Drugs Standard Control Organization (CDSCO). It is important to understand the regulatory environment because it impacts the industry’s operations, drug development, manufacturing, pricing, and distribution. Understanding regulations governing the pharmaceutical industry in India, pricing policies and patent laws, and identifying any legal or regulatory risks are all crucial factors to consider.

Why is it important to monitor market trends when analyzing a pharmaceutical company in India?

Monitoring market trends is important when analyzing a pharmaceutical company in India because it helps investors understand the demand for pharmaceutical products, competition, and emerging opportunities. Additionally, watching for geopolitical, economic, or social factors that could impact the industry or the company’s performance can provide valuable insights.

Why is it important to compare a pharmaceutical company’s financials, management, and growth prospects with industry peers?

Comparing a pharmaceutical company’s financials, management, and growth prospects with industry peers is important because it helps investors assess the company’s performance relative to its competitors. Analyzing valuation metrics such as price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio can also provide valuable insights.